Indian electric scooter manufacturer Ather Energy plans to raise about $370 million in its initial public offering, according to its draft prospectus filed on Monday (PDF), as the startup seeks to capitalize on growing demand for electric vehicles in the world’s third-largest auto market.

The Bengaluru-based startup, which competes with recently listed rival Ola Electric, is targeting a valuation of $1.5 billion to $2 billion, people familiar with the matter told TechCrunch. The company said it will sell new shares in the IPO as well as up to 22 million shares from existing investors.

Ather Energy declined to comment.

The startup said it will use the proceeds to fund a new manufacturing facility in the state of Maharashtra, repay borrowings, and for research and development.

Ather’s IPO plans come as India’s electric vehicle market heats up, driven by government incentives and rising fuel prices. The country aims to have 30% of private cars and 70% of commercial vehicles running on electricity by 2030.

Backed by India’s Hero MotoCorp and sovereign wealth fund National Investment and Infrastructure Fund, Ather Energy commanded about 19% of the electric two-wheeler market as of late August, according to government data.

The startup faces stiff competition from well-funded startups and established automakers rushing to grab a slice of India’s rapidly growing electric two-wheeler market. Ola Electric leads with a 31% share of the market, whereas TVS Motor and Bajaj Auto hold 20% and 19%, respectively. Hero has about 5% market share.

Incumbent automakers are ramping up their efforts to increase their presence in India’s EV market, and they’re seeing good results, too. Bajaj Auto’s market share stood at 11% at the end of June this year, for instance.

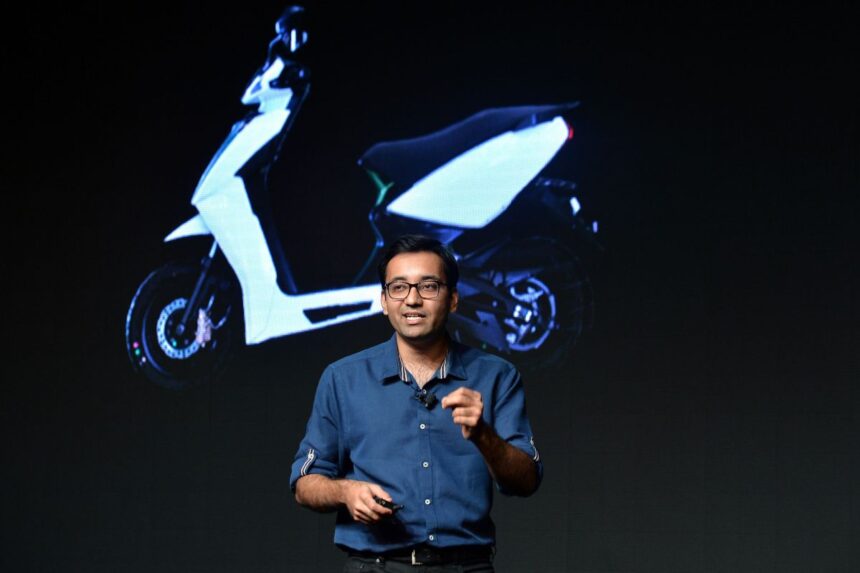

Founded in 2013 by Tarun Mehta and Swapnil Jain, Ather is known for its in-house design approach — 80% of its key components are designed internally. The company has raised about $500 million across several rounds, according to Tracxn, and it reported a loss of $126 million on revenue of $213 million in the fiscal year ended March.

Axis Capital, HSBC, JM Financial and Nomura are the lead book-runners for Ather’s IPO.

Source : Techcrunch