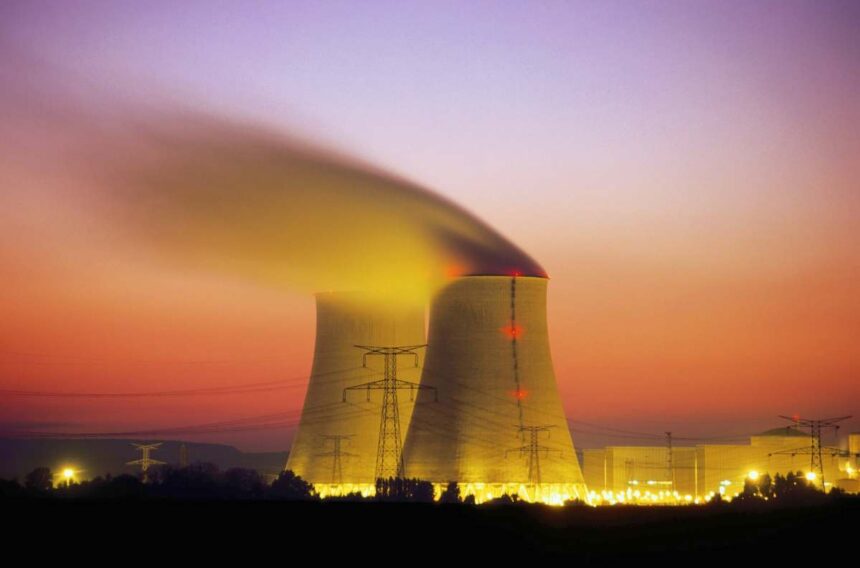

Microsoft made waves last week when it announced a deal with Constellation Energy to restart a nuclear reactor at Three Mile Island to meet its surging data center power needs, bucking the power source’s seemingly terminal decline.

In the last decade, seven nuclear reactors have been decommissioned in the U.S., while only two new ones have been switched on. Meanwhile, the number of data centers has exploded, with over 10,000 worldwide, half of which are in the U.S. And as cloud computing grows, EPRI, an electric industry research organization, anticipates that the sector’s energy demand will grow by anywhere from 29% to 166% by 2030.

Today, data centers consume about 4% of U.S. electricity. By the end of the decade, they might use 9%, all while overall demand grows. Hyperscale data centers, like what Microsoft, Google, and Amazon operate — and which startups like OpenAI and Anthropic rely on — are the primary culprit, responsible for 60 to 70% of all data center energy use, according to EPRI.

For companies like Microsoft, which has ambitions to eliminate its carbon emissions by 2030, growth in cloud computing and AI pose a particular challenge: The firm’s carbon emissions have ballooned some 40% over the last four years, largely a result of expanding data center operations. Google’s carbon emissions have grown, too, some 48% in the last five years. (Amazon says all of its data centers’ energy use is matched by an equivalent amount of renewable power.)

All of that has companies eyeing nuclear as a way to reconcile their breakneck data center growth with their commitments to hit net zero. In that context, it’s easy to see why nuclear is appealing: Fission reactors can run uninterrupted for years, working at maximum capacity over 90% of the time. Maintenance outages tend to be planned months or years in advance, giving data centers plenty of time to prepare. No wonder Microsoft signed a 20-year agreement with Constellation.

Outside of the new deal, Microsoft also has been investing, participating in a Series A for Last Energy, which is planning to build small modular reactors.

Not far from Three Mile Island, Amazon recently bought a hyperscale data center that’s directly connected to a nuclear plant, and it’s hiring a nuclear engineer to help AWS develop and acquire nuclear power.

Investors connected to Big Tech have placed their bets, too. Bill Gates co-founded TerraPower, and he has personally invested over $1 billion in the company; former Microsoft CTO Nathan Myhrvold, through Intellectual Ventures, is also on the cap table. Sam Altman backed the small modular reactor startup Oklo before it merged with a special-purpose acquisition company.

But Microsoft’s deal with Constellation suggests that the company is hedging its bets. The rapid company’s data center growth may have forced it to secure power more quickly than it had anticipated. It’s also possible that the company realized the current wave of nuclear startups won’t be generating electricity anytime soon.

The latter isn’t surprising. Nuclear reactors aren’t exactly simple, and many startups are still relatively young, having produced only plans or concepts of plans.

But even more mature startups have stumbled. Two years ago, the Nuclear Regulatory Commission denied Oklo’s application to build a reactor for the Department of Energy in Idaho, and last year the Air Force rescinded a $100 million cost-plus contract. Competitor NuScale Power, another fission startup that went SPAC, lost a big contract in 2023.

Even if nuclear fission startups are able to overcome their engineering and regulatory hurdles, they’ll still have to find somewhere to build them. That remains the biggest challenge, I’d argue. It’s no secret that nuclear has an image problem. How many of you cringed a bit when Microsoft announced it was reopening Three Mile Island, even if the reactor in question was operational as recently as 2019? And while the majority of Americans now support nuclear power, the technology lags in acceptance to wind and solar. Plus, that support may vanish once concrete plans emerge. People might like nuclear in the abstract, but what about in their backyards?

Meanwhile, the cost of renewable power has grown increasingly attractive, even when adding the cost of batteries to enable 24/7 operation.

In the near term, restarting old nuclear power plants will help tech companies keep up with growing power demand while minimizing its climate impact. But there are only so many mothballed nuclear power plants waiting for a savior. Eventually, cloud computing and AI companies will need alternative sources. The time to start looking for them is now.

Source : Techcrunch